- Take Action: Urge Congress to End Federal Cannabis Prohibition

- Alabama

- Alaska

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Delaware

- District of Columbia

- Florida

- Georgia

- Hawaii

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Mississippi

- Missouri

- Montana

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Vermont

- Virginia

- Washington

- West Virginia

- Wisconsin

- Wyoming

Cannabis Tax Revenue in States that Regulate Cannabis for Adult Use

- Issues

- Cannabis Legalization

- Cannabis Tax Revenue in States that Regulate Cannabis for Adult Use

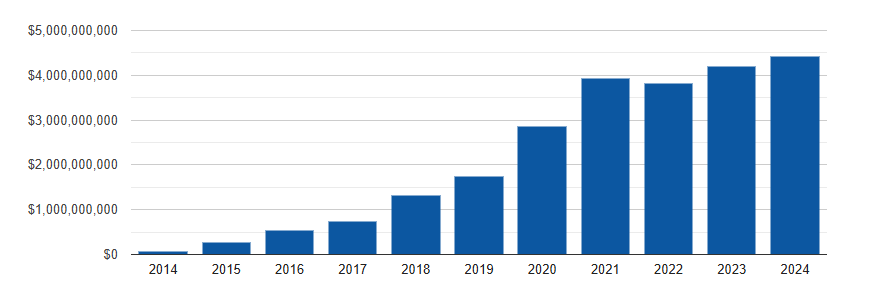

It has been over a decade since the first adult-use cannabis markets launched in Washington and Colorado in 2014. Since then, legalizing cannabis for adults has generated nearly $25 billion dollars in state tax revenue to invest in the needs of the states.

Twenty-four states have legalized cannabis possession for adults 21 and older. All but one of them — Virginia — have also legalized, regulated, and taxed cannabis sales. In two legalization states — Delaware and Minnesota — sales have not begun yet.

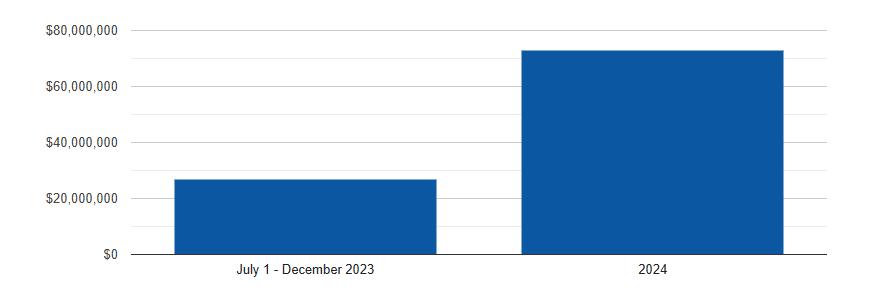

States have generated a combined total of more than $24.7 billion in tax revenue from legal, adult-use cannabis sales. In 2024 alone, legalization states generated more than $4.4 billion in cannabis tax revenue from adult-use sales, which is the most revenue generated by cannabis sales in a single year. In 2024, seven states collected over $200 million in adult-use cannabis taxes. Four of those states generated over $500 million in revenue, one of which collected over $1 billion.

States with legal, adult-use cannabis sales have allocated tax revenues to a variety of needs, including their General Funds and specific services and programs. Cannabis taxes have provided funding for Medicaid, education, school construction, housing, roads, early literacy, bullying prevention, behavioral health, alcohol and drug treatment, veterans’ services, conservation, job training, conviction expungement expenses, and reinvestment in communities that have been disproportionately affected by the war on cannabis, among many others.

This document reviews each legalization state’s adult-use cannabis tax structure, population, and year-by-year adult-use cannabis tax revenue. States are listed in chronological order, based on when state-legal cannabis sales began, with the most mature markets first. These figures include cannabis excise taxes and states’ standard sales taxes that are applied to cannabis. They do not include medical cannabis tax revenue, application and licensing fees paid by cannabis businesses, income taxes generated by workers in the cannabis industry, or taxes paid to the federal government. These figures also omit cities and towns’ tax revenue from municipal adult-use cannabis taxes.

Combined Totals By Year (All States)

Colorado (pop. 5.9 million) | Tax rate: 15% wholesale, 15% special retail

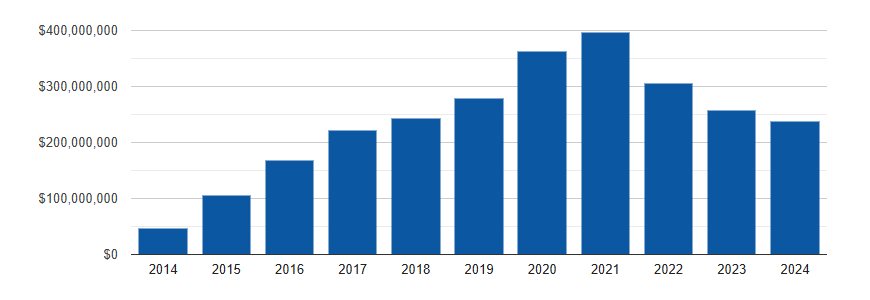

Colorado voters approved an initiative to regulate cannabis for adults in November 2012, and on January 1, 2014, the state became the first with legal adult-use sales. Colorado already had a developed medical cannabis regulatory system, and many businesses were able to transition to having both a medical and an adult-use counter.[1]

Colorado has generated over $2.6 billion in adult-use cannabis taxes since 2014. Every year since 2017 — the fourth year of sales — Colorado’s adult-use cannabis tax revenue exceeded $220 million.[2] More than $934 million of the revenue has been dedicated to Colorado’s public school system.[3]

The below chart shows the year-by-year totals for Colorado’s cannabis tax revenue. After seven years of rapid growth in cannabis sales and related tax revenue, Colorado has experienced reductions in adult-use cannabis tax revenue since 2021. Cannabis tax revenue peaked at $396 million in 2021. In 2024, the state generated $237 million in cannabis tax revenue.[4] Contributing factors in the recent decline include lower prices[5] and additional states legalizing, resulting in fewer out-of-state consumers. In addition, many states saw a short-term boost in cannabis sales and taxes in 2020-2021, during COVID shut downs.[6]

The $237.4 million Colorado collected in adult-use taxes in 2024 is more than four times the amount of alcohol taxes it collected in 2023.[7]

The figures do not count local sales tax revenues, which have been significant. The city of Denver, for example, applies its standard local sales tax of 4.81% and an additional 5.5% sales tax on adult-use cannabis and collected an estimated $39.6 million in cannabis tax revenue in 2024.[8]

| Year | State Tax Revenue from Adult-Use Cannabis[9] |

|---|---|

| 2014 | $46,104,922 |

| 2015 | $104,759,961 |

| 2016 | $167,157,150 |

| 2017 | $220,688,951 |

| 2018 | $243,466,892 |

| 2019 | $279,155,047 |

| 2020 | $362,027,103 |

| 2021 | $396,157,005 |

| 2022 | $305,034,034 |

| 2023 | $256,756,467 |

| 2024 | $237,436,232 |

| Total (through 2024) | $2,618,743,764 |

| Total (including revenue through April 2025) | $2,691,725,051 |

State Sales Tax Revenue from Adult-Use Cannabis (Colorado)

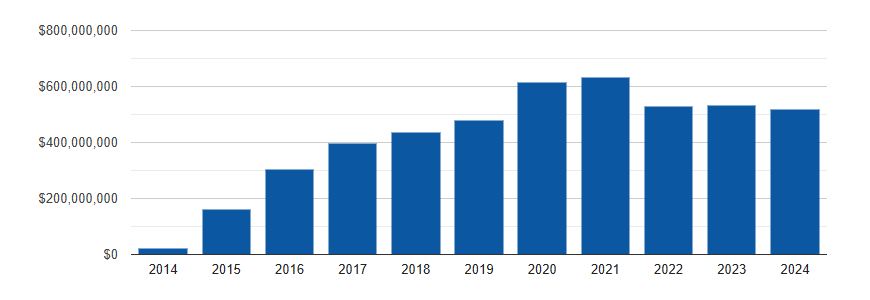

Washington (pop. 8 million) | Tax rate: 37% at retail; 6.5% sales tax

Washington’s voters also approved an adult-use measure in November 2012, and its first stores opened in July 2014. At the time, the state had an unregulated, arguably illegal, medical cannabis dispensary system, which was separate from the regulated adult-use program. This resulted in a slower ramp-up than in Colorado. Until July 2015, taxes were extremely high — 25% at three points of transfer — making it hard to compete with illegal sales. In 2015, the legislature changed the excise tax rate to 37% and created a medical endorsement program to which adult-use stores could apply to join. Washington’s cannabis taxes are among the highest in the nation.[10] Since sales began, the state has generated over $4.7 billion in cannabis excise and sales taxes. Every year since 2020, Washington has brought in more than half a billion dollars in cannabis tax revenue. Over half of the revenue is used for healthcare for low-income children.[11]

As was the case with Colorado, Washington saw steady annual growth in cannabis tax revenue until 2021. Tax revenue increased again in 2023, but then experienced a modest decrease in revenue for the second half of 2024 — for good reason. Starting on June 6, 2024, Washington began exempting medical cannabis patients from cannabis excise taxes.

The below chart shows annual excise and sales tax revenue in Washington state, by year. The figures do not include local taxes, which totaled an estimated $305.5 million from July 2014 through 2024.[12]

| Year | State Tax Revenue from Adult-Use Cannabis[13] |

|---|---|

| June – Dec. 2014 | $22,399,058 |

| 2015 | $159,451,910 |

| 2016 | $302,976,832 |

| 2017 | $397,358,420 |

| 2018 | $437,169,560 |

| 2019 | $477,310,790 |

| 2020 | $614,417,720 |

| 2021 | $630,863,570 |

| 2022 | $529,443,420 |

| 2023 | $532,516,060 |

| 2024 | $516,558,150 |

| Total (through 2024) | $4,620,465,490 |

| Total (including revenue through March 2025) | $4,723,168,980 |

Estimated State Sales Tax Revenue from Adult-Use Cannabis (Washington)

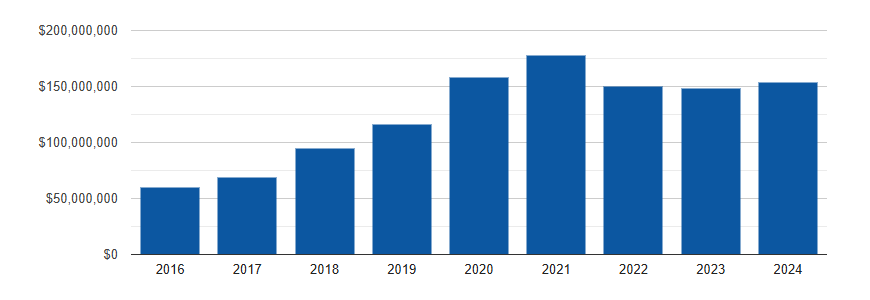

Oregon (pop. 4.2 million) | Tax rate: 17% at retail

Oregon voters approved an initiative regulating cannabis for adult use in November 2014, and the state’s first adult-use stores opened in October 2016. In addition, the legislature allowed medical cannabis dispensaries to sell a limited amount of cannabis (five grams) to adults from October 2015 until December 31, 2016. Those sales were taxed at 25% beginning January 4, 2016. The state’s medical patients (about 0.3% of Oregon’s population and dropping)[14] can buy cannabis tax-free from adult-use stores. In 2021, voters enacted Measure 110 and directed the bulk of the revenue to a new Drug Addiction Treatment and Recovery Services Fund.[15]

Oregon’s total adult-use cannabis revenue crossed $1 billion in 2024. The state saw a slight increase in cannabis tax revenue from $148 million in 2023 to $153 million in 2024.

The below annual tax revenues do not include the 3% sales tax some localities impose. From February 2017 through 2024, local taxes have generated $166 million.[16]

| Year | State Tax Revenue from Adult-Use Cannabis[17] |

|---|---|

| Feb. – Dec. 2016 | $60,154,432 |

| 2017 | $68,646,246 |

| 2018 | $94,226,985 |

| 2019 | $115,915,277 |

| 2020 | $158,336,274 |

| 2021 | $177,773,944 |

| 2022 | $150,316,424 |

| 2023 | $148,133,667 |

| 2024 | $153,795,374 |

| Total (through 2024) | $1,127,298,623 |

| Total (including revenue through March 2025) | $1,161,003,102 |

State Sales Tax Revenue from Adult-Use Cannabis (Oregon)

Alaska (pop. 730,000) | Tax rate at wholesale: $50/ounce for most flower; $25/ounce for immature/abnormal buds; $15/ounce for trim; clones: flat rate of $1

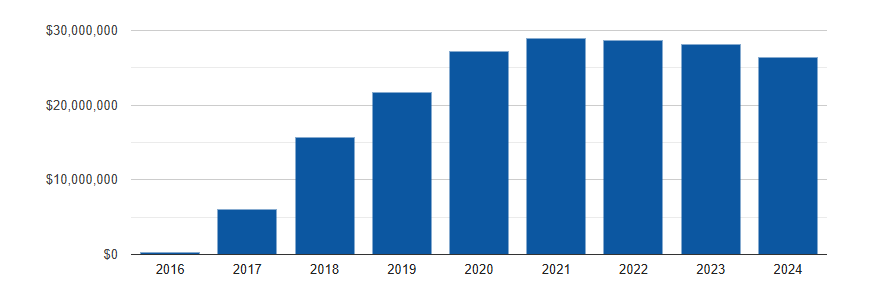

Alaska voters approved an initiative to regulate cannabis for adult use in November 2014, and the first adult-use stores opened in October 2016. A number of factors initially resulted in slower revenue generation than in some other states. The state’s medical cannabis program did not have dispensaries, meaning there were no cannabis businesses that could transition to adult-use cultivators and retailers. As a result of a limited supply, many stores closed for large stretches of January 2017 or operated with reduced hours.[18] Since sales began, Alaska has collected more than $189 million in cannabis excise tax revenue. Half of the revenue is now invested in the Recidivism Reduction Fund, which supports reentry programs for currently and formerly incarcerated individuals.[19] Since 2018, another 25% has been directed to the Marijuana Education and Treatment Fund.[20]

Tax revenue steadily climbed for the first five years, and peaked at $28.9 million in 2021. Since 2021, the state has seen a relatively modest decrease in cannabis tax revenue each year. Each year since 2020, annual cannabis tax revenue has still exceeded $26 million.

Alaska has one of the highest tax rates on cannabis. A September 2022 report by the Urban-Brookings Tax Policy Center found Alaska’s tax rate would be the highest in the nation if average cannabis prices were $100/ounce.[21] However, both Washington and Alaska’s prices appear to be over that threshold, and Washington appears to still have a higher effective tax rate.[22]

The below figures show Alaska’s year-by-year and total cannabis excise tax revenue. They do not include additional tax some localities impose.

| Year | State Tax Revenue from Adult-Use Cannabis[23] |

|---|---|

| Oct. – Dec. 2016 | $232,696 |

| 2017 | $6,075,069 |

| 2018 | $15,697,268 |

| 2019 | $21,672,822 |

| 2020 | $27,205,435 |

| 2021 | $28,900,231 |

| 2022 | $28,650,355 |

| 2023 | $28,097,114 |

| 2024 | $26,399,163 |

| Total (through 2024) | $182,930,153 |

| Total (including revenue through March 2025) | $189,260,225 |

State Sales Tax Revenue from Adult-Use Cannabis (Alaska)

Nevada (pop. 3.2 million) | Tax rate: 15% wholesale, 10% special retail, 6.85% standard sales tax

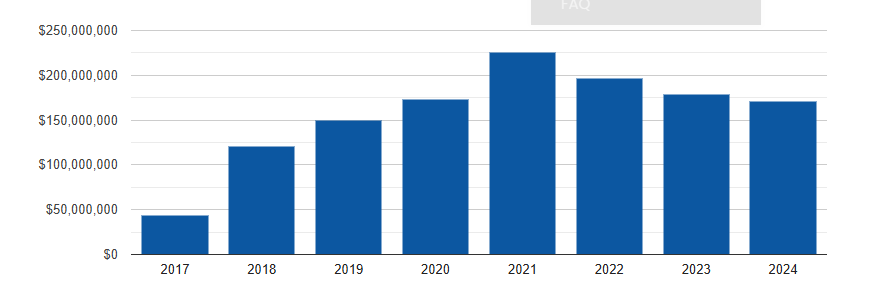

Nevada voters approved an initiative regulating cannabis for adult use in November 2016. The first adult-use stores were expected to be licensed in 2018, but the legislature and governor allowed medical cannabis dispensaries to sell to adults beginning on July 1, 2017. Nevada’s total cannabis tax revenue crossed the $1 billion threshold in 2023, six and a half years into legal sales. Nevada is transitioning data tracking systems and is the only state that has not yet released its full tax data from 2024. Based on projections from the first three quarters of the year, we estimate it generated approximately $171 million in cannabis tax revenue in 2024.

Nevada law allocates its entire 10% state retail excise tax to the State Education Fund. Meanwhile, each year, $5 million of the wholesale excise tax is distributed to local governments. After covering regulatory costs, the balance of all revenue from wholesale taxes, fees, and fines is also distributed to the State Education Fund. In fiscal year 2024, $107.8 million in cannabis revenue was directed to the state’s K-12 education budget from sales generated by the adult-use cannabis market.[24]

The below chart includes annual totals for Nevada’s cannabis excise and sales taxes. The figures do not count local sales taxes.

| Year | State Tax Revenue from Adult-Use Cannabis[25] |

|---|---|

| July – Dec. 2017 | $43,766,296 |

| 2018 | $120,111,184 |

| 2019 | $149,696,436 |

| 2020 | $172,493,138 |

| 2021 | $225,714,199 |

| 2022 | $196,952,338 |

| 2023 | $178,135,259 |

| 2024 (includes estimates for Q4) | $170,977,715 |

| Total through 2024 (including Q4 estimate for 2024) | $1,257,846,565 |

State Sales Tax Revenue from Adult-Use Cannabis (Nevada)

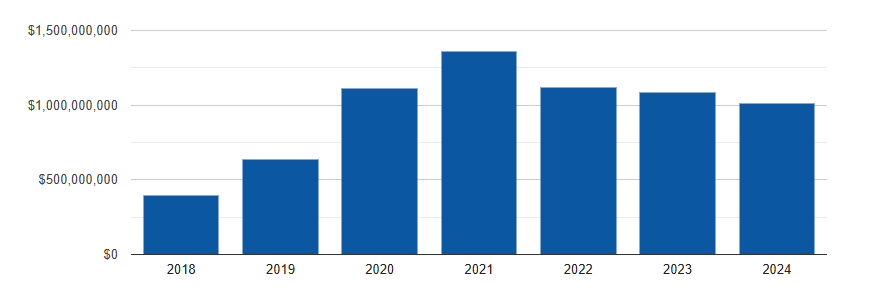

California (pop. 38.9 million) | Tax rate: 15% excise tax currently; 7.25% standard sales tax

California voters approved an initiative regulating cannabis for adults’ use in November 2016. The state’s first adult-use stores began to open in January 2018, but the transition from the state’s unregulated, grey market of medical cannabis providers to a licensed and regulated system has been more gradual and less complete than anticipated. The state’s long history of illicit cannabis production, favorable growing conditions, and continued demand from prohibition states have also meant illegal cultivation remains prevalent. In addition, many localities continue to prohibit cannabis stores, leaving swaths of prohibition that are still served by the untaxed illicit market.

California’s initial legalization law included a $9.25 per ounce tax on flowers, in addition to the current taxes, but that was removed in July 2022. Lawmakers were concerned the legal market was having difficulties competing against unregulated, untaxed sales. The bill also required an automatic increase in the retail excise tax starting in 2025 to offset cultivation taxes that were removed.[26] Effective July 1, 2025, the excise tax rate is scheduled to increase to 19%.[27] Lawmakers are considering removing the increase due to concerns that the hefty tax will drive more consumers to the illicit market, and drive cannabis licensees out of business.[28] Several cities and counties in California have reduced or eliminated local cannabis taxes.[29]

California has brought in over $6.7 billion in state cannabis tax revenue since legal sales began. Every year since 2020, the state has generated over $1 billion in excise and sales taxes on adult-use cannabis.

The voter-approved legalization law directs a significant portion of its cannabis tax revenue to local programs that benefit people adversely impacted by punitive drug laws. By April 2021, more than $100 million had already been distributed to community groups.[30] In both 2023 and 2024, more than $50 million was awarded to community reinvestment grants.[31] The state also invests large chunks of cannabis revenue into childcare services and environmental programs. The below figures do not include local sales and special taxes established by municipalities across the state.

| Year | State Tax Revenue from Adult-Use Cannabis[32] |

|---|---|

| 2018 | $397,343,905 |

| 2019 | $638,347,979 |

| 2020 | $1,110,476,931 |

| 2021 | $1,361,747,183 |

| 2022 | $1,115,967,422 |

| 2023 | $1,082,452,368 |

| 2024 | $1,009,294,380 |

| Total | $6,715,630,168 |

State Sales Tax Revenue from Adult-Use Cannabis (California)

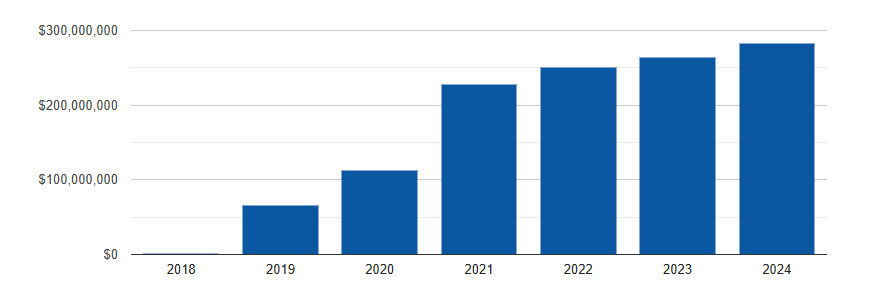

Massachusetts (pop. 7 million) | Tax rate: 10.75% excise tax on sales; 6.25% standard sales tax

Massachusetts voters approved an initiative regulating cannabis for adults’ use in November 2016. The first adult-use stores opened in November 2018.

Massachusetts has seen an increase in cannabis tax revenue every year since sales began. In 2024, Massachusetts brought in over $284 million in cannabis tax revenue. Early in the year, Massachusetts’ total adult-use cannabis tax revenue crossed the $1 billion threshold.

With the adult-use cannabis tax revenue collected so far, the state has invested millions of dollars into youth programs, public awareness campaigns, and a recently introduced Social Equity Trust Fund, which has distributed $26 million to hundreds of businesses across the state in Massachusetts.[33] Massachusetts allows cities and towns to impose an additional sales tax up to 3%. Figures below do not include those totals. In fiscal year 2024 alone, local cannabis taxes provided an additional $38 million in revenue to cities and towns in Massachusetts.[34]

| Year | State Tax Revenue from Adult-Use Cannabis[35] |

|---|---|

| Nov. – Dec. 2018 | $678,134 |

| 2019 | $66,243,027 |

| 2020 | $111,963,388 |

| 2021 | $227,474,843 |

| 2022 | $250,710,415 |

| 2023 | $263,488,752 |

| 2024 | $282,963,631 |

| Total (through 2024) | $1,203,522,190 |

| Total (including revenue through April 2025) | $1,297,433,078 |

State Sales Tax Revenue from Adult-Use Cannabis (Massachusetts)

Michigan (pop. 10 million) | Tax rate: 10% excise tax on sales; 6% standard sales tax

Michigan voters approved an initiative to legalize and regulate cannabis for adults’ use in November 2018. Sales began in December 2019.

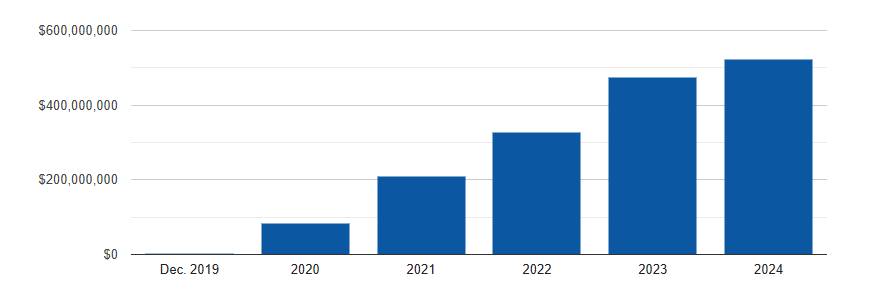

Michigan has collected more than $1.7 billion in adult-use cannabis tax revenues. Michigan has continued to see steady annual increases in tax revenue. For the first time, Michigan’s annual adult-use cannabis tax revenue topped $500 million in 2024. Only one of its border states — Ohio — has legal adult-use sales, which began in August 2024. Cross-border sales have contributed to Michigan’s cannabis sales and revenue.[36]

While localities can opt out of brick-and-mortar stores, delivery is allowed statewide. This provides for legal, regulated access across the state and reduces the illicit market.

Revenue is distributed as follows:

- 15% to municipalities and Indian Tribes that host one or more retail stores or microbusinesses

- 15% to counties that host one or more retail stores or microbusinesses

- 35% to the School Aid Fund for K-12 education

- 35% to the Michigan Transportation Fund for roads[37]

In fiscal year 2024, over $116 million in cannabis tax revenue went to the School Aid Fund for K-12 education, and another $116 million to the Michigan Transportation Fund.[38] For each store or microbusiness they hosted, municipalities, counties, and tribes received $58,228.66. The total distribution to localities, counties, and tribes in FY 2024 was over $99.4 million.[39]

| Year | State Tax Revenue from Adult-Use Cannabis[40] |

|---|---|

| Dec. 2019 | $1,118,289 |

| 2020 | $81,705,350 |

| 2021 | $209,912,278 |

| 2022 | $326,049,074 |

| 2023 | $473,303,560 |

| 2024 | $523,552,765 |

| Total (through 2024) | $1,615,641,316 |

| Total (including revenue through April 2025) | $1,781,057,996 |

Estimated State Sales Tax Revenue from Adult-Use Cannabis (Michigan)

Illinois (pop. 12.5 million) | Tax rate: 7% at wholesale; from 10-25% at retail, depending on potency; 6.25% standard sales tax

On June 25, 2019, Gov. J.B. Pritzker signed HB 1438 into law, legalizing and regulating cannabis for adults’ use. Sales from existing medical cannabis businesses began on January 1, 2020.

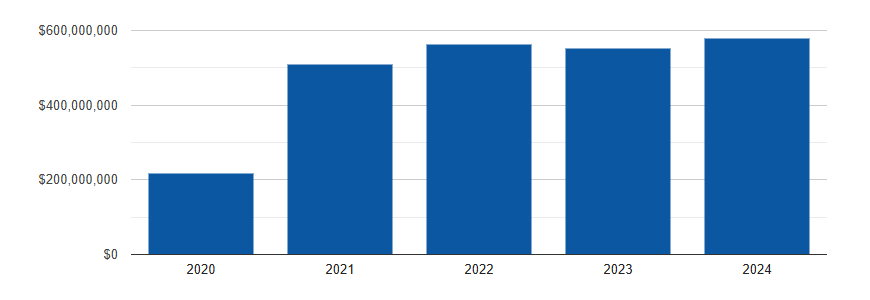

In the second year of sales, 2021, cannabis tax revenue surpassed half a billion dollars. From 2022 to 2023, Illinois’ cannabis revenue slightly declined for the first time. That is at least partially because neighboring Missouri legalized adult-use cannabis with one of the lowest excise tax rates in the nation. This reduced Illinois’ revenue from out-of-state customers, and led to some central Illinoisans buying cannabis in Missouri to save money. Illinois’ cannabis taxes rebounded in 2024, generating a record $577 million — an increase of around $25 million from 2023’s revenues. Also in 2024, Illinois surpassed $2 billion in cannabis revenue since legal sales began in 2020.

Illinois’ law puts a strong emphasis on social equity and repairing harms caused by enforcement of laws that criminalized cannabis. In addition to investing 20% of adult-use cannabis tax revenue into mental health services, the state directs 25% of the funds to the Recover, Reinvest, and Renew Program, which supports local organizations in developing programs that benefit disadvantaged communities. Illinois has distributed over $380 million to this fund since legal cannabis sales began.[41]

| Year | State Tax Revenue from Adult-Use Cannabis[42] |

|---|---|

| 2020 | $216,525,000 |

| 2021 | $509,358,442 |

| 2022 | $562,119,019 |

| 2023 | $552,166,729 |

| 2024 | $577,412,683 |

| Total (through 2024) | $2,417,581,872 |

| Total (including revenue through March 2025) | $2,557,261,326 |

State Sales Tax Revenue from Adult-Use Cannabis (Illinois)

Maine (pop. 1.4 million) | Tax rate: Wholesale tax of $335 per pound of flower with lower rates for trim and seedlings; 10% sales tax

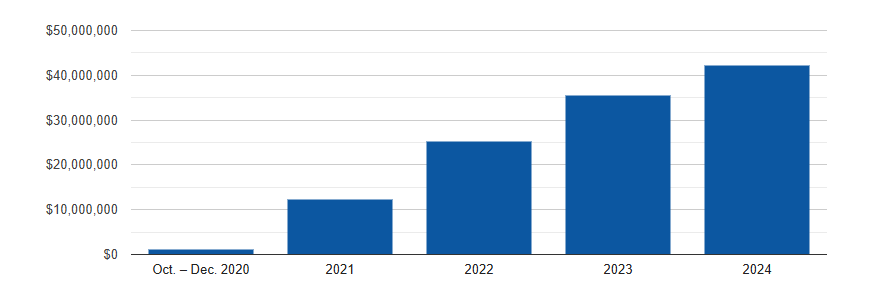

Maine voters approved an initiative regulating cannabis for adults’ use in November 2016, but sales did not begin until October 9, 2020. Every year since sales began, Maine has seen an increase in cannabis tax revenue. In 2024, the state — which is home to just under 1.5 million residents — collected $42 million in revenue.

The state’s legalization law divides cannabis tax revenue into two funds, one to support public health initiatives and the other for public safety and law enforcement training.

| Year | State Tax Revenue from Adult-Use Cannabis[43] |

|---|---|

| Oct. – Dec. 2020 | $1,156,878 |

| 2021 | $12,362,622 |

| 2022 | $25,329,534 |

| 2023 | $35,593,347 |

| 2024 | $42,201,086 |

| Total (through 2024) | $116,643,467 |

| Total (including revenue through March 2025) | $126,858,423 |

State Sales Tax Revenue from Adult-Use Cannabis (Maine)

Arizona (pop. 7.4 million) | Tax rate: 16% excise tax on sales; 5.6% standard transaction privilege tax

Arizona voters approved an initiative regulating cannabis for adults’ use on November 3, 2020. Sales from around 120 existing medical cannabis businesses began less than four months later — on January 21, 2021.

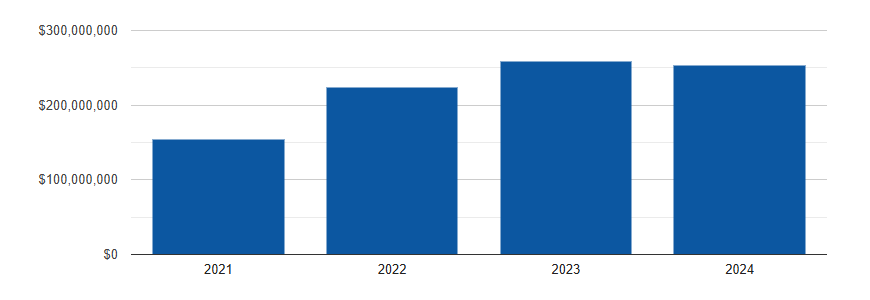

Cannabis sales and tax revenues started out stronger than many states. Adult-use cannabis sales topped $1 billion in both 2023 and 2024. In 2024, the state brought in over $253 million in excise taxes and transaction privilege taxes on adult-use cannabis, a slight decrease from the nearly $258 million generated in 2023.

After regulatory and enforcement costs are paid, Arizona’s law distributes excise tax revenue as follows: 33% of the cannabis tax revenue to community colleges, 31.6% to law enforcement and fire departments, 25.4% to transportation programs, and 10% to public health and criminal justice programs.[44]

| Year | State Tax Revenue from Adult-Use Cannabis[45] |

|---|---|

| 2021 | $153,824,757 |

| 2022 | $223,863,799 |

| 2023 | $257,926,777 |

| 2024 | $253,061,173 |

| Total (through 2024) | $888,676,506 |

| Total (including revenue through March 2025) | $951,076,657 |

State Tax Revenue from Adult-Use Cannabis (Arizona)

Montana (pop. 1.1 million) | Tax rate: 20% excise tax on sales

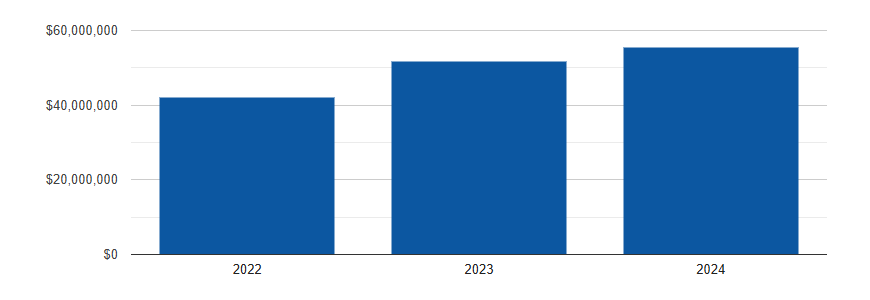

Montana voters approved an initiative regulating cannabis for adults’ use on November 3, 2020. Sales began on January 1, 2022. In its third full year of sales, 2024, Montana generated over $55 million in cannabis excise taxes, the highest yet. State law directs that revenue to substance abuse recovery programs, conservation efforts, and services for veterans and their families. In 2024, the Legislature passed SB 537, which would revise allocations of funds, including directing a substantial portion of the revenue to law enforcement. As of this writing, Gov. Greg Gianforte (R) has not acted on the bill yet.

| Year | State Tax Revenue from Adult-Use Cannabis[46] |

|---|---|

| 2022 | $41,989,466 |

| 2023 | $51,636,106 |

| 2024 | $55,521,165 |

| Total (through 2024) | $149,146,737 |

| Total (including revenue through March 2025) | $162,436,150 |

State Tax Revenue from Adult-Use Cannabis (Montana)

New Mexico (pop. 2.1 million) | Tax rate: 12% retail excise until July 1, 2025, which then increases by one percentage point per year, maxing out at 18% on July 1, 2030; 5.125% state gross receipts tax

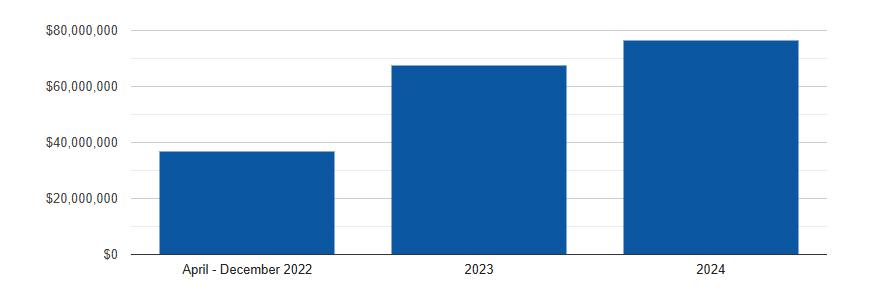

New Mexico’s Cannabis Regulation Act legalizes and regulates cannabis for adults 21 and older. It passed the legislature on March 31, 2021, during a special session called for that purpose by Gov. Michelle Lujan Grisham. Gov. Grisham signed the bill on April 12, 2021. Sales began on April 2, 2022.

In its first full year of legal adult-use sales, New Mexico generated over $67 million in tax revenue. Meanwhile, in its second full year of legal adult-use sales, New Mexico generated over $76 million in tax revenue.

Much of the cannabis excise tax revenue goes to the municipal governments where sales take place.

| Year | State Tax Revenue from Adult-Use Cannabis[47] |

|---|---|

| April – Dec. 2022 | $36,684,235 |

| 2023 | $67,440,312 |

| 2024 | $76,506,067 |

| Total (through 2024) | $180,630,614 |

| Total (including revenue through April 2025) | $205,039,556 |

State Tax Revenue from Adult-Use Cannabis (New Mexico)

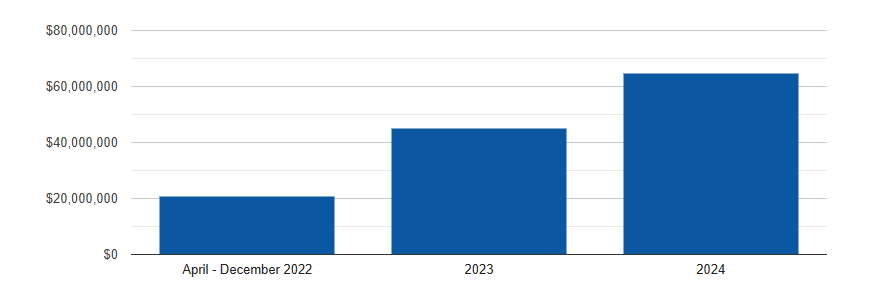

New Jersey (pop. 9.3 million) | Tax rate: 6.625% standard sales tax, 1-2% local option taxes; fluctuating excise fee based on average sale price

On November 3, 2020, more than two-thirds of New Jersey voters approved a legislatively-referred constitutional amendment directing the legislature and the Cannabis Regulatory Commission to regulate cannabis for adults’ use.

In March 2021, lawmakers approved twin bills to implement the amendment. In addition to the standard sales taxes and local cannabis taxes, New Jersey’s law imposes social equity excise fees (SEEF) on sales from cultivators, which regulators can adjust each year. The cultivation excise fees started at one-third of one percent of average retail sales prices. Beginning nine months after adult-use sales begin, and every year thereafter, the Cannabis Regulatory Commission can revise the fees, with fees increasing as the average retail price of cannabis drops. The Commission can levy excise fees at the following rates:

- up to $10 per ounce when average retail prices per ounce are $350 or higher;

- up to $30 per ounce when average retail prices per ounce are at least $250 but less than $350;

- up to $40 per ounce when average retail prices per ounce are at least $200 but less than $250; and

- up to $60 per ounce when average retail prices drop below $200 per ounce.

Sales began on April 21, 2022.

As of December 2024, New Jersey retail prices averaged $336 per ounce of flower.[48] The SEEF was $1.10 per ounce in 2022, and increased to $1.52 per ounce in 2023.[49] In 2024, the SEEF was reduced to $1.24 per ounce of cannabis. It was increased to $2.50 per ounce on January 1, 2025.

Taxes from New Jersey’s legal cannabis market largely support goals to promote social equity. The law requires 70% of cannabis revenue to provide economic assistance and services to “impact zones,” which are areas of the state disproportionately affected by prior enforcement of cannabis criminalization laws. In 2023, Gov. Phil Murphy announced that $5 million in tax revenue from legal cannabis sales will be used to help fund an initiative focused on stopping and preventing violence within the state.[50]

| Year | Tax and SEEF Revenue from Adult-Use Cannabis[51] |

|---|---|

| April – Dec. 2022 | $20,838,514 |

| 2023 | $45,083,223 |

| 2024 | $64,503,651 |

| Total | $130,425,388 |

Tax and SEEF Revenue from Adult-Use Cannabis (New Jersey)

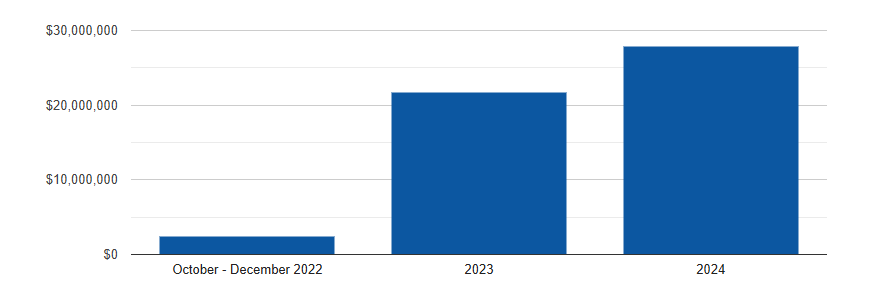

Vermont (pop. 647,000) | Tax rate: 14% excise tax on sales; 6% standard sales tax

On October 7, 2020, Gov. Phil Scott (R) allowed S. 54 to go into law without his signature. The law legalizes, regulates, and taxes cannabis sales for adults’ use. The legislature and governor had legalized personal possession and cultivation only in 2018. Regulated sales began on October 1, 2022.

In its first full year of legal sales, the small state generated over $21.3 million in cannabis excise taxes and sales taxes on adult-use cannabis. In the state’s second full year of legal sales, the state generated over $27.8 million in cannabis excise taxes and sales taxes on adult-use cannabis, an increase of $6.2 million from its first year of sales. Vermont’s law requires that cannabis tax revenue be used “to establish a grant program that supports the expansion of universal afterschool and summer programs with a focus on underserved areas of the State.”[52]

| Year | State Tax Revenue from Adult-Use Cannabis[53] |

|---|---|

| Oct.- Dec. 2022 | $2,371,429 |

| 2023 | $21,642,857 |

| 2024 | $27,842,857 |

| Total (through 2024) | $51,857,143 |

| Total (including revenue through March 2025) | $58,650,569 |

State Tax Revenue from Adult-Use Cannabis (Vermont)

Rhode Island (pop. 1 million) Tax rate: 10% excise, 3% local sales tax, 7% standard sales tax

On May 25, 2022, Gov. Dan McKee signed the Rhode Island Cannabis Act into law, legalizing and regulating cannabis for adults 21 and older. Sales began on December 1, 2022.

In its first full year of legal sales, Rhode Island generated over $12.6 million in state tax revenue from adult-use cannabis. Meanwhile, in the state’s second full year of legal sales, Rhode Island generated over $15.9 million in state tax revenue from adult-use cannabis.

Cannabis excise tax revenue is deposited into a restricted receipt account within the state’s general fund. It can be used to support program administration; revenue collection and enforcement; substance use disorder prevention for adults and youth; education and public awareness campaigns, including awareness campaigns relating to driving under the influence of cannabis; treatment and recovery support services; public health monitoring, research, data collection, and surveillance; and law enforcement training and technology improvements, including grants to local law enforcement.[54]

| Year | State Tax Revenue from Adult-Use Cannabis[55] |

|---|---|

| Dec. 2022 | $579,439 |

| 2023 | $12,621,982 |

| 2024 | $15,995,635 |

| Total (through 2024) | $29,197,056 |

| Total (including revenue through April 2025) | $34,555,111 |

State Tax Revenue from Adult-Use Cannabis (Rhode Island)

New York (pop. 19.5 million) | Tax rate: 9% cannabis wholesale tax, 9% cannabis sales tax; 4% local sales tax

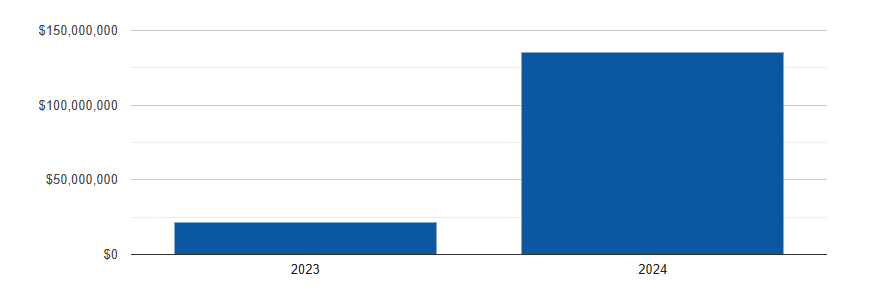

On March 31, 2021, then-Gov. Andrew Cuomo signed legislation (S.854-A/A.1248-A) legalizing and regulating cannabis for adults in New York. Sales began at a single location on December 29, 2022. We do not have tax revenue information for the three days in 2022 that New York had legal cannabis sales. Additional retailers have opened since then. As of December 2024, New York State had 260 adult-use cannabis dispensaries.[56]

New York has had one of the rockiest transitions to adult-use legal sales. A very small number of legal cannabis stores were authorized initially, while thousands of unlicensed cannabis stores began openly operating.[57] The unlicensed stores employ signage and other marketing that is prohibited on the regulated market. This has resulted in less per capita revenue than other states have been able to realize.[58] Provisions in New York’s 2024 budget allowed for stores illegally selling cannabis to be padlocked shut, and nearly 1,400 were shuttered in New York City alone.[59]

In 2024, New York replaced a potency tax with the 9% wholesale excise tax.[60] Until April 20, 2024, rather than a 9% wholesale tax, New York levied a tax per milligram of THC: $0.005 per milligram in flower, $0.008 per milligram in concentrates, and $0.03 per milligram for edibles. After regulatory and administrative costs, including workforce development, incubators, and drug recognition expert (DRE) training, 40% of cannabis revenue goes to education, 40% goes to community reinvestment, and 20% supports drug treatment and education.[61]

| Year | State Tax Revenue from Adult-Use Cannabis[62] |

|---|---|

| 2023 | approximately $21,500,000 |

| 2024 | approximately $135,000,000 |

| Total | approximately $156,500,000 |

State Tax Revenue from Adult-Use Cannabis (New York)

Connecticut (pop. 3.6 million) | Tax rate: THC-based excise tax: $0.00625 per milligram of THC in flower cannabis; $0.0275/mg of THC in edibles; $0.009/mg of THC in other cannabis products; 6.35% standard sales tax; 3% tax to the municipality where the sales occurred

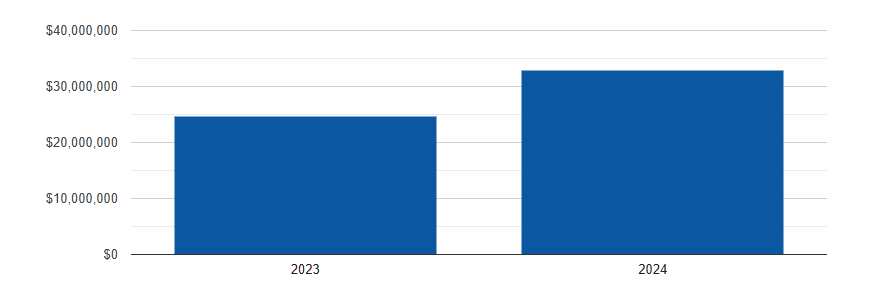

On June 22, 2021, Gov. Ned Lamont signed S.B. 1201 — “An Act Concerning the Equitable and Responsible Regulation of Cannabis” — into law, after it passed the Connecticut House and Senate.

Sales began on January 10, 2023. In its first year of legal sales, Connecticut generated over $24 million in state tax revenue from adult-use cannabis. In the state’s second year of sales, Connecticut saw $32 million in tax revenue.

Twenty-five percent of Connecticut’s excise tax goes to the Prevention and Recovery Services Fund. Until June 30, 2026, 60% of the excise tax will go to the Social Equity and Innovation Fund. On July 1, 2026, that would increase to 65%. Beginning on July 1, 2028, it would increase again and would remain at 75%.[63] The 3% tax that goes to municipalities must be used for one of five specific purposes, such as re-entry services, mental health or addiction services, youth services bureaus, and streetscape improvements near cannabis retailers.[64]

| Year | State Tax Revenue from Adult-Use Cannabis[65] |

|---|---|

| Jan. 10 - Dec. 2023 | $24,613,367 |

| 2024 | $32,773,606 |

| Total (through 2024) | $57,386,972 |

| Total (including revenue through March 2025) | $63,038,324 |

State Tax Revenue from Adult-Use Cannabis (Connecticut)

Missouri (pop. 6.2 million) Tax rate: 6% excise tax on sales; standard 4.225% state sales tax; and local taxes

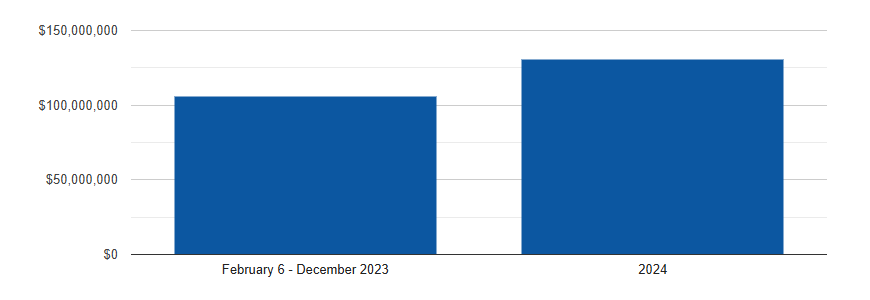

Missouri voters approved an initiative regulating cannabis for adults’ use on November 8, 2022. Sales from existing medical cannabis businesses began on February 6, 2023. In its first 11 months of legal sales, Missouri generated nearly $106 million in state tax revenue from adult-use cannabis. In 2024, the second year of sales, Missouri garnered over $130 million in cannabis revenue.

After retaining no more than 2% of tax revenues, the Department of Revenue deposits the remainder into the “Veterans, Health, and Community Reinvestment Fund.” The fund initially covers any additional implementation costs, including the expungement of past cannabis convictions. The remainder is split evenly between three categories: veterans services, community grants related to treating substance use disorder and preventing drug overdose deaths, and the public defender system. As of April 8, 2025, the fund has transferred over $27 million each to the Missouri Veterans Commission and the Department of Health and Human Services, along with over $15 million to the Public Defender System.[66]

| Year | State Tax Revenue from Adult-Use Cannabis[67] |

|---|---|

| Feb. 6 - Dec. 2023 | $105,941,225 |

| 2024 | $130,824,785 |

| Total (through 2024) | $236,766,010 |

| Total (including revenue through April 2025) | $281,499,363 |

State Tax Revenue from Adult-Use Cannabis (Missouri)

Maryland (pop. 6.2 million) Tax rate: 9% at point of sale, increased to 12% beginning July 1, 2025

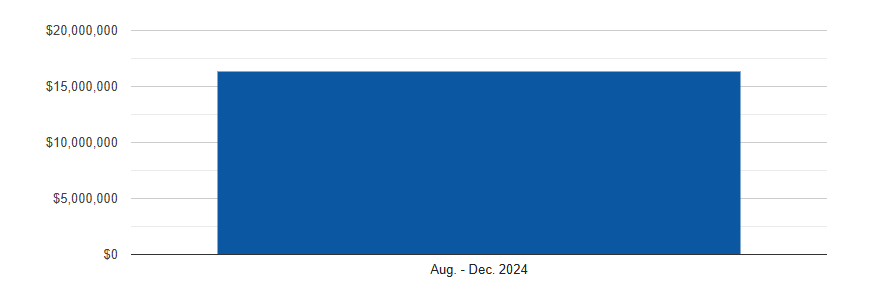

On November 8, 2022, Maryland voters overwhelmingly approved a legislatively-referred ballot measure to legalize adults’ possession of cannabis. The General Assembly and governor enacted legislation in 2023 to enact a regulatory framework for sales. Existing medical dispensaries began sales to adult-use consumers on July 1, 2023, and a lottery was held in April 2024 for new social equity licenses.

In the first eight months of legal cannabis sales, Maryland generated more than $40 million in cannabis tax revenue. In 2024, Maryland’s first full year of sales, the state saw over $72 million in cannabis tax revenue.

Initially, Maryland imposed a 9% retail tax on cannabis sales, which was one of the lowest cannabis tax rates in the nation. Pursuant to legislation passed in 2025 to address a budget gap, the rate will increase to 12% starting July 1, 2025.[68] After administrative costs, tax revenue is distributed to a Community Reinvestment and Repair Fund (35% until fiscal year 2033), a Cannabis Business Assistance Fund (5% until 2028), to counties (5% with half going to municipalities), and the Cannabis Public Health Fund (5%).[69] The remainder goes to the General Fund.

| Year | State Tax Revenue from Adult-Use Cannabis[70] |

|---|---|

| July 1 - Dec. 2023 | $26,734,752 |

| 2024 | $72,934,285 |

| Total (through 2024) | $99,669,037 |

| Total (including excise taxes due through April 2025) | $125,589,037 |

State Tax Revenue from Adult-Use Cannabis (Maryland)

Ohio (pop. 11.8 million) Tax rate: 10% excise tax on sales; standard 5.75% state sales tax; and local taxes (up to 2.25%)

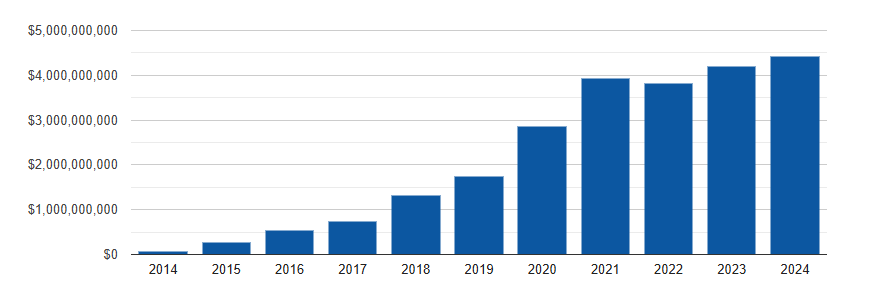

On November 7, 2023, voters approved Issue 2, making Ohio the 24th state to legalize cannabis for adults 21 and older. Legal adult-use cannabis sales began on August 7, 2024, from existing medical cannabis businesses.

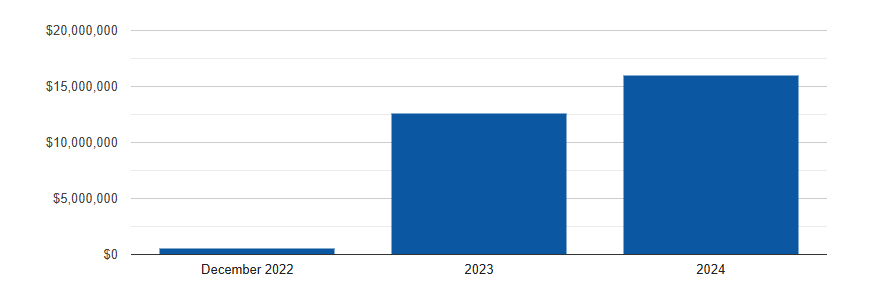

From August 7, 2024, through the year’s end — just under five months, Ohio generated over $16 million in adult-use cannabis taxes. In the first four months of 2025, Ohio generated another $16 million in cannabis tax revenue.

Ohio’s legalization law imposes a 10% excise tax on retail sales of adult-use cannabis and allocates the excise tax revenue to: 36% for the social equity and jobs programs; 36% to communities hosting adult-use cannabis dispensaries; 25% to substance use disorder education and treatment; and 3% for cannabis regulatory and administrative costs. During the 2025 legislative session, Gov. Mike DeWine (R) and some lawmakers are proposing reducing the allocations to host communities to 20% for five years and reallocating the remainder to the General Fund.[71]

| Year | State Tax Revenue from Adult-Use Cannabis[72] |

|---|---|

| Aug. - Dec. 2024 | $16,340,096 |

| Total (through 2024) | $16,340,096 |

| Total (including revenue through May 17, 2025) | $35,370,975 |

State Tax Revenue from Adult-Use Cannabis (Ohio)

Delaware (pop. 900,000 million) Tax rate: 15% excise tax on sales

On April 22 and April 26, 2023, then-Gov. John Carney (D) allowed companion legalization bills — HB 1 and HB 2 — to become law without his signature.

Delaware’s initial legalization law did not provide for existing compassion centers (medical cannabis licensees) converting to dual use. On July 17, 2024, Governor Carney signed into law HB 408, which allows them to apply to also serve adult-use consumers, to speed up adult-use access and revenue. In late 2024, the Office of the Marijuana Commissioner awarded a total of 124 cannabis licenses by lottery.[73] The licenses are conditional and require several additional steps to be taken to convert to active licenses.

Cannabis sales were anticipated to begin in Spring 2025, but the process was delayed after the FBI said language that was used did not allow FBI background checks on applicants and workers. Lawmakers revised that language and sales are anticipated soon.

Cannabis will be taxed at 15% at the point of retail sales to consumers. Seven percent of the proceeds are allocated to a Justice Reinvestment Fund, while the remainder will be deposited in the General Fund.

Minnesota (pop. 5.8 million) Tax rate: 10% at retail, plus standard 6.875% sales tax

On May 30, 2023, Gov. Tim Walz (D) signed HF 100 into law, legalizing cannabis for adults 21 and older. Unlike most adult-use states, the bill did not allow existing medical cannabis businesses — of which there are only two — to convert to also sell to adult-use consumers.

Adult-use sales have not begun as of this writing. In February and March 2025, more than 3,500 applicants applied for licenses.[74] Licenses are anticipated in May 2025.[75]

In May 2025, lawmakers and the governor reached a budget agreement that would raise taxes to 15% at retail, plus standard sales taxes.[76]

Adult-Use Cannabis Tax Revenue — All States

| Year | States' Cannabis Tax Revenue |

|---|---|

| 2014 | $68,503,980 |

| 2015 | $264,211,871 |

| 2016 | $530,521,110 |

| 2017 | $736,534,982 |

| 2018 | $1,308,693,928 |

| 2019 | $1,749,459,667 |

| 2020 | $2,856,307,217 |

| 2021 | $3,934,089,074 |

| 2022 | $3,816,898,917 |

| 2023 | $4,185,783,924 |

| 2024 | $4,421,894,498 |

| Total (through 2024) | $23,872,899,167 |

| Total (including partial 2025 data) | $24,706,657,398 |

Combined Totals By Year (All States)

Closing Thoughts

With states facing an uncertain fiscal landscape, strained budgets, and a possible economic downturn, legalizing and taxing cannabis for adults helps lessen the pain. Taxes on a single product cannot solve all of a state’s financial challenges. But it helps. In several states, cannabis tax revenue brings in more than alcohol taxes.[77] In states with mature markets, adult-use cannabis taxes often amount to 0.25% to 1.5% of the entire state budget.[78]

$4.42 billion — the total state tax haul in 2024 for adult-use cannabis taxes — is enough to cover 582,000 people on Medicaid.[79] That’s an average of more than 27,700 people in each of the 21 states that had adult-use cannabis sales in 2024.

Adult-use cannabis legalization also frees up law enforcement resources to focus on crimes with victims and creates thousands of new jobs. It is important to note that the financial impact of legalizing and regulating cannabis for adult use is one of the many benefits of legalization. In states that are home to 54% of the U.S. population, adults are now free to choose to use cannabis to relax or as an over-the-counter medicine for sleep, pain, and other ailments. Since states began legalizing cannabis, hundreds of thousands of individuals have been spared traumatic arrests,[80] possible incarceration, and criminal records that shut the door of opportunity. Meanwhile, teenagers’ cannabis use rates decreased in most states after they legalized cannabis and moved sales to businesses that check ID.[81] Legalization also allows regulation, enabling potency labels and regulations for harmful pesticides, heavy metals, and molds. Voter support has grown as more states legalize cannabis.

Nationwide, Gallup reports 68% of Americans now believe cannabis use should be legal. That is double the 34% support from 2003.[82]

[1] Meanwhile, Colorado medical cannabis sales decreased from $199 million in fiscal year 2012 to $163 million in 2024. While medical cannabis patients are exempt from excise taxes in Colorado, they often must pay medical cannabis specialists for a certification and a registry fee, and many prefer not to be on a government list. (“Marijuana Sales Report January 2014 to December 2024," Colorado Department of Revenue, https://docs.google.com/spreadsheets/d/14uJdPV4LxzJCt5KDznokaOh_PqdkjKBd/edit?gid=1239670133#gid=1239670133; Michael Roberts, "Medical marijuana revenues in Colorado for 2012: $199 million-plus," Westword, June 4, 2013. https://www.westword.com/news/medical-marijuana-revenues-in-colorado-for-2012-199-million-plus-5848937)

[2] "Marijuana Tax and Fee Revenue Report,” February 2014 to Date," Colorado Department of Revenue. https://cdor.colorado.gov/data-and-reports/marijuana-data/marijuana-tax-reports (column N)

[3]"Marijuana_Tax_Revenue_2014_To_Date_Report," Colorado Department of Revenue https://docs.google.com/spreadsheets/d/1e8hnG64Vkg9ffgkNpKQ1kzPsXNbGjG2X/edit#gid=208699827 Totals of columns I, L, and M

[4] "Marijuana Tax and Fee Revenue Report,” February 2014 to Date," Colorado Department of Revenue. (column N)

[5] Katy Marquardt Hill, "Colorado’s mellowing marijuana industry," CU Boulder Today, Jan. 2, 2024.

[6] See: Gillian L. Schauer et al, “Cannabis sales increases during COVID-19: Findings from Alaska, Colorado, Oregon, and Washington,” International Journal of Drug Policy, Volume 98, 2021,103384, ISSN 0955-3959,

[7]"2023 Annual Report," Colorado Department of Revenue, p. 83. https://cdor.colorado.gov/sites/revenue/files/documents/2023_Annual_Report_DR4000_0.pdf

[8] City of Denver presentation of marijuana sales tax revenue. https://app.powerbigov.us/view?r=eyJrIjoiODFhZmZlMWItOTViOC00MjcxLTk0ZDEtMzVkOWFmODk4N2I2IiwidCI6IjM5Yzg3YWIzLTY2MTItNDJjMC05NjIwLWE2OTZkMTJkZjgwMyJ9

[9]"Marijuana Tax Reports," Colorado Department of Revenue https://cdor.colorado.gov/data-and-reports/marijuana-data/marijuana-tax-reports;

[10] Because states’ tax methods and prices differ, this changes as wholesale and retail prices change. For example, Alaska’s $50/ounce tax would be higher than Washington’s 37% excise tax + standard 6.5% sales tax if average prices drop below $114.94/ounce in both states.

[11]"Dedicated Cannabis Account appropriations and expenditures," JLARC, Nov. 2023, p. 11. https://leg.wa.gov/jlarc/reports/2023/cannabisRevenues/p_i/Presentation.pdf

https://leg.wa.gov/jlarc/reports/2023/cannabisRevenues/p_i/default.html

[12]"Cannabis sales tax table," Washington Department of Revenue, last updated: May 2025 https://dor.wa.gov/about/statistics-reports/recreational-and-medical-marijuana-taxes (“Estimated state sales tax collections” plus applying the 37% tax to "Total retail value of cannabis and cannabis products (before tax)")

[13] Id. "Estimated state sales tax collections" plus applying the 37% tax to "Total retail value of cannabis and cannabis products (before tax)"

[14] "The Oregon Medical Marijuana Program Statistical Snapshot April 2025," Oregon Health Authority, p. 1. https://www.oregon.gov/oha/PH/DISEASESCONDITIONS/CHRONICDISEASE/MEDICALMARIJUANAPROGRAM/Documents/OMMP_Statistic_Snapshot_04-2025.pdf (12,948 patients with an address in Oregon. The U.S. Census shows a population of 4.2 million)

[15]Carmine Gemei, "Ripple Effect: Measure 110's impact on where your cannabis tax money goes," KTVL, April 16, 2022. Distributions available at "Oregon Marijuana Tax: Distribution Information," Oregon Department of Revenue Research Section, March 12, 2025: https://www.oregon.gov/dor/programs/gov-research/Documents/Financial%20reporting%20distributions%20public.pdf

[16] "Oregon Marijuana Tax Statistics: Accounting Information," Oregon Department of Revenue Research Section, April 23, 2025 ("State Tax Received") www.oregon.gov/dor/programs/gov-research/Documents/Financial%20reporting%20receipts%20public.pdf

[17] Id. ("Local Tax Received")

[18] Laurel Andrews, “Legal weed is hard to come by in Alaska,” Alaska Dispatch News, January 5, 2017.

[19] "Marijuana Tax 2024 Report of Marijuana Transferred or Sold," Alaska Department of Revenue. https://tax.alaska.gov/programs/programs/reports/monthly/MarijuanaReport.aspx

[20] Id.

[21] Richard Auxier and Nikhita Airi, "The Pros and Cons of Cannabis Taxes," Tax Policy Center, 2022. https://www.urban.org/sites/default/files/2022-09/Pros%20and%20Cons%20of%20Cannabis%20Taxes_0.pdf

[22] "Washington Cannabis Sales," Headset, April 2025. (Reporting an average price of $16.26 per 1/8th ounce in Washington, which is $130.08 per ounce. In Washington, the sale would be subject to $56.58 in excise and sales taxes. Alaska’s ounce would be taxed $50.) Prices in Alaska appear to significantly higher than $100/ounce: https://www.priceofweed.com/prices/United-States/Alaska.html (accessed May 22, 2025).

[23] "Report of Marijuana Transferred or Sold," Alaska Department of Revenue, 5/9/2025. https://tax.alaska.gov/programs/programs/reports/monthly/MarijuanaReport.aspx ("Total Collected Tax.")

[24] "CCB/DoT Release Annual Cannabis Taxable Sales Data," Cannabis Compliance Board, Dec. 12, 2024 https://ccb.nv.gov/wp-content/uploads/2024/12/CCB-DoT-Release-Annual-Cannabis-Taxable-Sales-Data-for-release.pdf (Note that these figures are only the excise taxes and do not include standard sales taxes.) .

[25] "Cannabis Tax Revenue," Nevada Department of Taxation (Most recent data at: https://tax.nv.gov/wp-content/uploads/2024/12/NV-Cannabis-Revenue-FY25.pdf and https://tax.nv.gov/wp-content/uploads/2024/07/NV-Cannabis-Revenue-FY24.pdf (In the first nine months of 2024, $91,410,901 was collected in cannabis excise taxes. Based on calculations from sales, $36,822,385 was collected from standard sales taxes on adult-use cannabis. This is a total of $128,233,286 in the first nine months of the year. Extrapolating from that amount for the final three months of the year would result in $170,977,715 in taxes for all of 2024.)

[26] "Cannabis Tax Revenue Update (2024 Q4)," Legislative Analyst's Office, March 6, 2025. https://lao.ca.gov/LAOEconTax/article/Detail/824

[27] "Cannabis Special Notice: New Cannabis Excise Tax Rate Effective July 1, 2025," California Department of Tax and Fee Administration, L-979 (4-25). https://www.cdtfa.ca.gov/formspubs/l979.pdf

[28] "California’s cannabis tax set to rise to 19%, but lawmakers debate possible relief," ABC 10, May 9, 2025. May 9, 2025. https://www.abc10.com/article/news/local/californias-cannabis-tax-increase/

[29] Chris Roberts, "California cities, counties cut marijuana taxes to aid struggling companies," MJ Biz Daily, Aug. 22, 2023. https://mjbizdaily.com/california-cities-counties-cut-cannabis-taxes/

[30]Jim Rendon, "Nonprofits gain funding from unusual source: Marijuana sales," AP, April 23, 2021. https://apnews.com/article/marijuana-business-california-recreational-marijuana-ae20c17fc439570783d6be602e2e4e6f

[31] California Officials Award More Than $50 Million In Marijuana Tax-Funded Community Reinvestment Grants https://www.marijuanamoment.net/california-officials-award-more-than-50-million-in-marijuana-tax-funded-community-reinvestment-grants/ "California Community Reinvestment Grants Program: FY 2024-2025 Grant Recipients," Governor's Office of Business and Economic Development, May 2025. https://business.ca.gov/wp-content/uploads/2025/05/CalCRG-Program-Grantee-List-5-2025.pdf

[32]"Cannabis Tax Revenues," California Department of Tax and Fee Administration, https://www.cdtfa.ca.gov/dataportal/dataset.htm?url=CannabisTaxRevenues

[33] "Massachusetts Adult-use Cannabis Sales Hit Annual Record with $1.64 Billion Generated Over 2024," Cannabis Control Commission, January 16, 2025. https://masscannabiscontrol.com/2025/01/massachusetts-adult-use-cannabis-sales-hit-annual-record-with-one-point-sixty-four-billion-generated-over-2024/

[34] “Massachusetts Blue Book,” Massachusetts Department of Revenue, April 2025 https://www.mass.gov/lists/massachusetts-dor-blue-book-reports#fy2025 ("Local Option Marijuana")

[35]"Total Tax Revenue Collections," the Commonwealth of Massachusetts CTHRU. (To find monthly totals, after selecting the appropriate fiscal year and month, under Revenue Source, select values: Cannabis Sales Tax (0420) and Cannabis Excise Tax (0422)) https://cthru.data.socTotal Tax Revenue Collections | CTHRUrata.com/dataset/Total-Tax-Revenue-Collections/me5t-fei2

[36] Hannah Davis-Reid, "Wisconsinites cross the state border for marijuana sales," WXPR, Sept. 26, 2023.

[37] "Adult-Use (Recreational) Marijuana," Michigan Department of Treasury. https://www.michigan.gov/treasury/local/share/marijuana/adult-use

[38] "Michigan municipalities getting nearly $100 million from marijuana tax," Bridge Michigan, February 21, 2025. https://www.bridgemi.com/michigan-government/michigan-municipalities-getting-nearly-100-million-marijuana-tax

[39] "Adult-Use Marijuana Distributions Based on Marijuana Revenues Collected in Fiscal Year 2024," Michigan Department of Treasury, February 2025. https://www.michigan.gov/treasury/-/media/Project/Websites/treasury/ORTA/Adult-Use-Marijuana/FY-2024/FY-2024-Adult-Use-Marijuana-Distributions-updated-2202025.pdf

[40]"Cannabis Regulatory Agency Statistical Reports," Cannabis Regulatory Agency. Available at: https://www.michigan.gov/lara/0,4601,7-154-89334_79571_93032-497635--,00.html (For each month, under "Adult-Use Establishment Licensing," multiply the total sales figure by the tax rate.)

[41] Dylan Sharkey, “How does Illinois spend millions in cannabis cash?” Illinois Policy, April 15, 2024. https://www.illinoispolicy.org/how-does-illinois-spend-millions-in-cannabis-cash/

[42] “Monthly Collections Remitted to the State Comptroller,” Illinois Revenue https://tax.illinois.gov/research/taxstats/collectionscomptroller.html See the “Cannabis” tab of the reports linked on this webpage, then scroll down to “Comptroller fund receipts” for the cultivation and retail excise taxes received; Standard sales taxes are calculated from total sales to in-state residents and out-of-state residents found at: "Illinois Monthly Adult Use Cannabis Sales," https://public.data.illinois.gov/t/Public/views/CannabisSalesFigures/AdultUseCannabisSales?%3Aembed=y&%3Aiid=1&%3AisGuestRedirectFromVizportal=y

[43]"Sales Tax Reports," Maine Revenue Services: Monthly Cannabis Taxable Sales Statewide and Adult-Use Tax Revenue (MS Excel) (Adding adult-use sales tax revenue and excise tax revenue) https://www.maine.gov/revenue/taxes/tax-policy-office/sales-tax-reports

[44]Benjamin Newcomb, “Ballot Proposition 207 Smart and Safe Arizona Act Fiscal Analysis,” Arizona Joint Legislative Budget Committee. https://www.azleg.gov/jlbc/20novI-23-2020fn730.pdf

[45] “Marijuana Tax Collection,” Arizona Department of Revenue. Total Tax Collections for “Adult Use - 902" and "Excise Tax - 920” https://azdor.gov/reports-statistics-and-legal-research/marijuana-tax-collection

[46] “Monthly Cannabis Sales Reports,” Montana Department of Revenue, https://revenuefiles.mt.gov/cannabis-sales-reports (“Adult-Use Sales” times 0.2 for each month)

[47]Cannabis Reporting Online Portal (CROP), New Mexico Regulation & Licensing Department. (sales data, which is then multiplied by tax rates) available at: https://crop.rld.nm.gov/sales.html

[48] Tony Lange, "How Much Does an Ounce of Cannabis Flower Cost in 2025?" Cannabis Business Times, December 23, 2024. https://www.cannabisbusinesstimes.com/top-stories/news/15710420/how-much-does-an-ounce-of-cannabis-flower-cost-entering-2025

[49] "Social Equity Excise Fee (SEEF)," New Jersey Division of Taxation. https://www.nj.gov/treasury/taxation/cannabis/recreational/seef.shtml

[50] "Governor Murphy, Attorney General Platkin Announce $15 Million in Violence Prevention and Intervention Grants Available for Community Organizations," Office of the New Jersey Attorney General, August 15, 2023. https://www.njoag.gov/governor-murphy-attorney-general-platkin-announce-15-million-in-violence-prevention-and-intervention-grants-available-for-community-organizations/

[51] "Cannabis Sales Totals – 2024” "Cannabis Sales Totals – 2023," "Cannabis Sales Totals – 2022," New Jersey Regulatory Commission (Recreational Tax Revenue and Social Equity Excise Fees) https://www.nj.gov/cannabis/documents/Quarterlies/Rec%20Med%20sales%20Q4%2024.pdf

[52]16 VT Stats § 51.

[53]"Cannabis Excise Tax Statistics," Vermont Department of Taxes. https://tax.vermont.gov/data-and-statistics/cannabis-excise-tax (Excise taxes are rounded to the nearest $10,000, and standard sales taxes are calculated from those figures).

[54] R.I. Gen. Laws § 21-28.11-13

[55] “Rhode Island Cannabis Data,” Office Of Cannabis Regulation https://dbr.ri.gov/office-cannabis-regulation/data (tax revenue was calculated from sales data by multiplying it by the excise and sales tax rates)

[56] “The New York State Office of Cannabis Management Releases 2024 Market Report Analyzing First Two Years of Legal Sales,” New York State Office of Cannabis Management, April 25, 2025.

[57] See: Mona Zhang, "New York eyes crackdown on illicit weed shops. Will it work?," Politico, April 10, 2024.

[58] New York generated $4.02 in tax revenue on adult-use cannabis per resident in 2024, the lowest of any state with a full year of sales in 2024. The second lowest state per capita was New Jersey at $6.92 per person. Connecticut was the only other state under $10 per capita, at $9.04. (Calculations are based on figures in this report.)

[59] "1,400 illegal pot shops padlocked in the first year of crackdown, Adams says," NY 1, May 14, 2025.

[60] McKinney's Tax Law § 493. (In the case of vertically integrated businesses, the tax accrues at the point of retail sale and is 75% the 9% — or 6.75%.)

[61]"What is in the Law: Taxation and Revenue," New York Office of Cannabis Management https://cannabis.ny.gov/system/files/documents/2024/06/5.22-cannabis-management-fact-sheet-taxation.pdf

[62] For cannabis taxes until Sept. 30, 2023, we used the figures from "New York State Office of Cannabis Management Annual Report," 2023, p. 19 Table 8 https://cannabis.ny.gov/system/files/documents/2023/12/annual-report-2023-final.pdf Only partial data after that date has been released, so the later figures were estimated using sales data, which was reported. "New York State Office of Cannabis Management Market Report 2024," Office of Cannabis Management, p. 12. https://cannabis.ny.gov/system/files/documents/2025/04/2024-ocm-market-report.pdf To estimate the 9% retail tax collections, 9% was applied to all sales figures. For the 9% wholesale tax that began on June 1, 2024, we used the 6.75% retail rate the law uses for vertically integrated businesses. For the potency tax estimates from Oct. 1, 2023, through May 31, 2024, we extrapolated from the actual sales and tax data from 2023 to estimate that the potency tax added another 6% at retail and then multiplied the sales data by 6%. Of note, the "New York State Office of Cannabis Management Market Report 2024" includes total state tax revenue through 3/31/2024 — $ 42,004,000 — and from 4/1/2024 to 9/30/2024 — $61,948,000. This would be a total of $103.9 million. Applying the estimates for tax revenue for sales only for Q4 of 2024 would be $52.5 million. That would be a grand total of $156.4 million, which is very close to our estimate for 2024-2025 state tax revenue using the other methodology.

[63] Conn. Gen. Stat. § 12-330ll (i)

[64] Conn. Gen. Stat. § 12-330mm.

[65]Excise taxes: “Cannabis Tax,” Connecticut Open Data: https://data.ct.gov/Tax-and-Revenue/Cannabis-Tax/jey2-vq68/data_preview (Total Tax); Sales taxes calculated from adult-use retail sales at "Cannabis Retail Sales by Month," Connecitcut Open Data: https://data.ct.gov/Health-and-Human-Services/Cannabis-Retail-Sales-by-Month/f382-bnu5

[66] "Data and Reports," Missouri Department of Health and Senior Services, https://health.mo.gov/safety/cannabis/stats.php ("Adult-Use Transfer History")

[67] Calculated by applying excise tax and sales taxes to the adult-use sales figures posted to "Data and Reports," Missouri Department of Health and Senior Services, under “Monthly Sales Dashboard,”at https://health.mo.gov/safety/cannabis/img/cumulative-monthly-sales.jpg Note that the sales figures all rounded to the nearest $100,000, so the tax figures are not precise.

[68] See: Bryan Sears, "House, Senate quickly come to agreement on spending and tax plan," Maryland Matters, April 4, 2025.

[69] Md. Code, Tax-Gen. §2–1302.2.

[70] For 2023 and 2024 data: "Cannabis Tax Reports," Comptroller of Maryland. https://www.marylandcomptroller.gov/cannabis/tax-reports.html 2025 partial data is calculated from adult-use sales figures at "MCA Medical and Adult-Use Cannabis Data Dashboard," Maryland Cannabis Administration

at https://cannabis.maryland.gov/Pages/Data-Dashboard.aspx (sales data are rounded to nearest million)

[71] See: George Dimov, "Ohio Cannabis Tax: 2025 Rates, Revenue Allocation & Legislative Updates," Dimov Tax Specialists, May 14, 2025. https://dimovtax.com/ohio-cannabis-tax

[72] Tax revenue is calculated from sales figures at "Historical Sales Data." Ohio Department of Commerce, Division of Cannabis Control https://dam.assets.ohio.gov/image/upload/com.ohio.gov/DCC/DCC_Historical_Sales_Data.docx.pdf

[73] "OMC selects 15 marijuana retail applicants" Delaware Business Times, Jan. 2, 2025.

[74] "Thousands vie for Minnesota adult-use marijuana licenses; 2025 launch possible," MJ Biz Daily, March 28, 2025.

[75] Corin Hoggard, "Minnesota's marijuana month could be in May, not April this year," Fox 9, April 14, 2025.

[76] "Minnesota marijuana tax hike proposed ahead of legal sales launch," MJBizDaily, May 19, 2025.

[77] "Five Years in, Cannabis Tax Haul Rivals or Exceeds Alcohol Taxes in Many States" Institute on Taxation and Economic Policy, January 23, 2019.

[78] "Cannabis Excise Taxes," U.S. Census, March 13, 2025.

[79] Rhiannon Euhus and Priya Chidambaram, "A Look at Variation in Medicaid Spending Per Enrollee by Group and Across States," KFF, Aug 16, 2024. https://www.kff.org/medicaid/issue-brief/a-look-at-variation-in-medicaid-spending-per-enrollee-by-group-and-across-states/

[80] Marijuana have arrests dropped from at least 749,825 in 2021 to at least 217,150 in 2023. (See: Steven Nelson, “Police Made One Marijuana Arrest Every 42 Seconds in 2012," U.S. News, Sept. 16, 2013; Kyle Jaeger, “More Than 200,000 People Were Arrested Over Marijuana Last Year In The U.S., The Vast Majority For Possession, New FBI Report Shows,” Marijuana Moment, September 25, 2024.)

[81] For data and citations, see: "Adult Use Legalization Corresponds With Drop In Teen Marijuana Use," Marijuana Policy Project. www.mpp.org/issues/legalization/adult-use-legalization-corresponds-with-drop-in-teen-marijuana-use/

[82] "Americans’ Support for the Legalization of Marijuana, 1969-2024," Gallup, at https://news.gallup.com/poll/284135/percentage-americans-smoke-marijuana.aspx

Prepared by Bridget Spiddle. Edited by Karen O'Keefe and Violet Cavendish. Designed by Garret Overstreet.